|

Startup FAQs

What percentage of inventions become start-ups?

What are some examples of University of Colorado start-up companies?

Why does CU encourage start-ups?

Why does CU seek equity as consideration for licensing CU IP?

Is equity the University’s only financial remuneration?

Why does the University structure license agreements with multiple income streams?

What happens upon equity liquidation?

What happens to future improvements to technology licensed to a start-up?

How do I find out more about start-up companies at CU?

What percentage of inventions become start-ups?

Roughly 5%-10% of inventions meet the criteria necessary to become start-up companies. At CU, this translates to 5-10 start-ups per annum depending on the number of invention disclosures the Tech Transfer Office receives in any given year.

Back to top

What are some examples of University of Colorado start-up companies?

CU researchers have a history of inventing groundbreaking platform technology that forms the basis for a number of successful start-ups. Some leading examples include:

- Under the research sponsorship of a Boulder start-up company, a drug now marketed as Kineret®, originated in the lab of CU HSC professor and Chief of Rheumatology, William Arendt. Dr. Arendt discovered a protein that stops the inflammation and destruction associated with autoimmune disorders. Through a series of business transactions, Amgen acquired rights to Kineret. Recently, Amgen announced FDA approval of Kineret to treat rheumatoid arthritis.

- Myogen, a Colorado-based biopharmaceutical company dedicated to discovering, developing and commercializing drugs for the treatment of heart failure and related cardiovascular complications.

- Dharmacon, a licensee of research directed by CU inventors Marvin Caruthers and Steven Scaringe that markets products and customized RNA-synthesis services to research laboratories.

- SomaLogic, a company located in Boulder, CO started by inventor Larry Gold, is developing a highly specific and sensitive tool for measuring and identifying proteins as keys to early diagnosis of human disease.

- CDM Optics, a CU-based startup, developing technology that greatly improves the clarity of images through a lens, using patented “depth-of-field” technologies from CU labs.

- Nobel prize winner, Thomas Cech, CU-Boulder Professor of Chemistry, in the late 1980s discovered that RNA could behave like an enzyme. His ribozyme discoveries were the basis for forming Ribozyme Pharmaceuticals, Inc., located in Boulder, which today employs 135 people.

Back to top

Why does CU encourage start-ups?

There are several reasons why the TTO works to create start-ups from university inventions.

- Start-ups translate academic inventions into commercial goods and services that benefit the public. This is consistent with the mission of universities.

- A track record of successful start-ups helps during discussions about recruitment and retention of high quality faculty.

- Start-ups are an engine for local economic development and job creation, and success in this area demonstrates value of university research to the broader community.

- Start-ups are sometimes the only alternative. In some cases, individual technologies cannot be licensed piecemeal. A great deal of work needs to be done to identify, package, and present a basket of technologies that cohesively offer a commercialization opportunity.

- Start-ups make money -for the inventor, the university, and the business and investment community.

Back to top

Why does CU seek equity in consideration for licensing CU IP?

Equity is the currency most readily available to start-up companies. Since start-ups usually begin as a concept, they need time to assemble the resources necessary to maximize chances for success. Often, the TTO, and the faculty inventor wishing to create a start-up, are in a kind of “chicken and egg” situation. The start-up needs a secure commitment from the University that it has, or will soon obtain, full and exclusive rights to market a particular technology and the University seeks to grant licenses only to entities it believes have the capability of rapidly, and profitably, commercializing the technology.

To bridge this gap, the TTO works to create conditions that are ripe for investment in the start-up. Financially, this means the TTO acts as a founder of the company, understanding that start-ups typically have little cash and no revenues. As a founder, the University typically accepts non-marketable stock in lieu of cash as compensation. Founders stock is viewed as a reasonable business solution to enhance the overall financial package for the technology –acceptable to the company and its future investors, while providing an opportunity for the University to participate in the upside of the company.

Back to top

Is equity the university's only financial remuneration?

No. Stock is not received in preference to cash, but as an adjunct to both up-front license fees and future royalty streams. One way to view the University’s position is to look at start-ups from the perspective of opportunity cost.

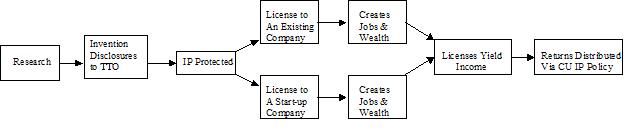

The University of Colorado assumes right, title, and interest to inventions and related intellectual property created by University employees. As a result of this policy, and certain obligations under the federal Bayh-Dole Act, the University has created the TTO and tasked it with commercializing technologies created at the University. As the chart below shows, this is typically done in one of two ways: Licensing to an existing entity or creating a start-up.

In both cases, the interests of the inventor and the University are aligned. Each party seeks to maximize their return on investment. However, when the TTO invests intellectual property into a start-up, it is deferring compensation that might be received from licensing the technology to an established company. In some cases, this deferred income, otherwise known as opportunity cost, can amount to significant sums over the period of a license.

Therefore, to mitigate risk and provide the University with the opportunity to increase its potential return, licenses with equity generally do include cash payments such as:

- Up-front license fees (where applicable and imposing a low cash burden)

- Minimum annual and/or milestone payments

- Royalties on Net Sales

- Sublicense Royalties

Back to top

Why does the university structure license agreements with multiple income streams?

Two reasons. First, as discussed above, the University’s contribution to a start-up is usually in the form of an exclusive license to a portfolio of intellectual property assets. As a company grows, so does its need for follow-on financing. Because the University does not have the cash to participate in later-stage rounds of financing, all compensation must be negotiated in the original license with an understanding that whatever the University receives is the maximum it will ever receive. As such, the University seeks to negotiate economic terms that allow the institution to participate fairly in the upside of the company, without unduly hampering the company’s ability to raise capital and execute its business plan.

Second, the TTO’s mission is to determine the best and highest use of the technology and then to structure an agreement that ensures the technology will be commercialized for the public benefit. Financial terms, such as Minimum Annual Payments and Sub-License Royalties, are mechanisms to discourage companies from either sitting on potentially valuable technologies (not actively marketing) or merely brokering technologies (acting as a middleman and providing little if any development and commercialization value). In most cases, the TTO will also include certain diligence provisions in a License Agreement that further encourages the Licensee to actively commercialize technology licensed from the University.

Back to top

What happens upon equity liquidation?

When the stock held by ULEHI is sold, the proceeds are transferred to the TTO for distribution in accordance with the University’s royalty sharing policy.

Back to top

What happens to future improvements to technology licensed to a start-up?

In most cases, start-up companies seek exclusive licenses from the University to the intellectual property needed to form the core assets of the business. However, in nearly all cases, the work performed in the lab to generate the underlying IP continues well after the initial disclosure and subsequent patenting process. Additional discoveries are often more important to the commercialization of technology than the original invention. As a result, companies seek to secure rights to follow-on improvements via an Option to Future Improvements. Options grant a company a period of time in which to evaluate an improvement for inclusion in the company’s IP asset portfolio. If the company elects to exercise the Option, this can be done for a small up-front fee and an agreement to incorporate the new technology into the company’s License Agreement under the same terms and conditions as the original. If the company decides not to license the new technology, it is returned to the TTO for licensing elsewhere.

Back to top

How do I find out more about campus start-up companies at CU?

Please contact your TTO campus representative or Tom Smerdon, Director of Business Development, at 303-735-0621. tom.smerdon@cu.edu.

Back to top

|